The Definitive Guide to Paul B Insurance

Table of ContentsThe Single Strategy To Use For Paul B InsurancePaul B Insurance Fundamentals ExplainedAll About Paul B InsuranceHow Paul B Insurance can Save You Time, Stress, and Money.Examine This Report about Paul B Insurance

Today, homeowner, automobile proprietors, organizations and also establishments have readily available to them a large range of insurance items, a number of which have come to be a need for the performance of a free-enterprise economy. Our society could barely function without insurance policy. There would so a lot uncertainty, a lot direct exposure to abrupt, unexpected perhaps devastating loss, that it would be challenging for any person to intend with self-confidence for the future.The bigger the variety of premium payers, the more properly insurance companies are able to estimate probable losses therefore determine the amount of premium to be accumulated from each. Because loss incidence may alter, insurers remain in a constant procedure of gathering loss "experience" as a basis for periodic evaluations of premium requirements.

In this regard, insurers execute a resources formation function similar to that of financial institutions. Therefore, business enterprises acquire a double benefit from insurancethey are made it possible for to operate by transferring possibly debilitating danger, and they likewise might get resources funds from insurers via the sale of stocks as well as bonds, for example, in which insurers spend funds.

For extra on the insurance coverage industry's payments to culture and the economic climate see A Company Foundation: Just How Insurance Coverage Supports the Economic Climate.

How Paul B Insurance can Save You Time, Stress, and Money.

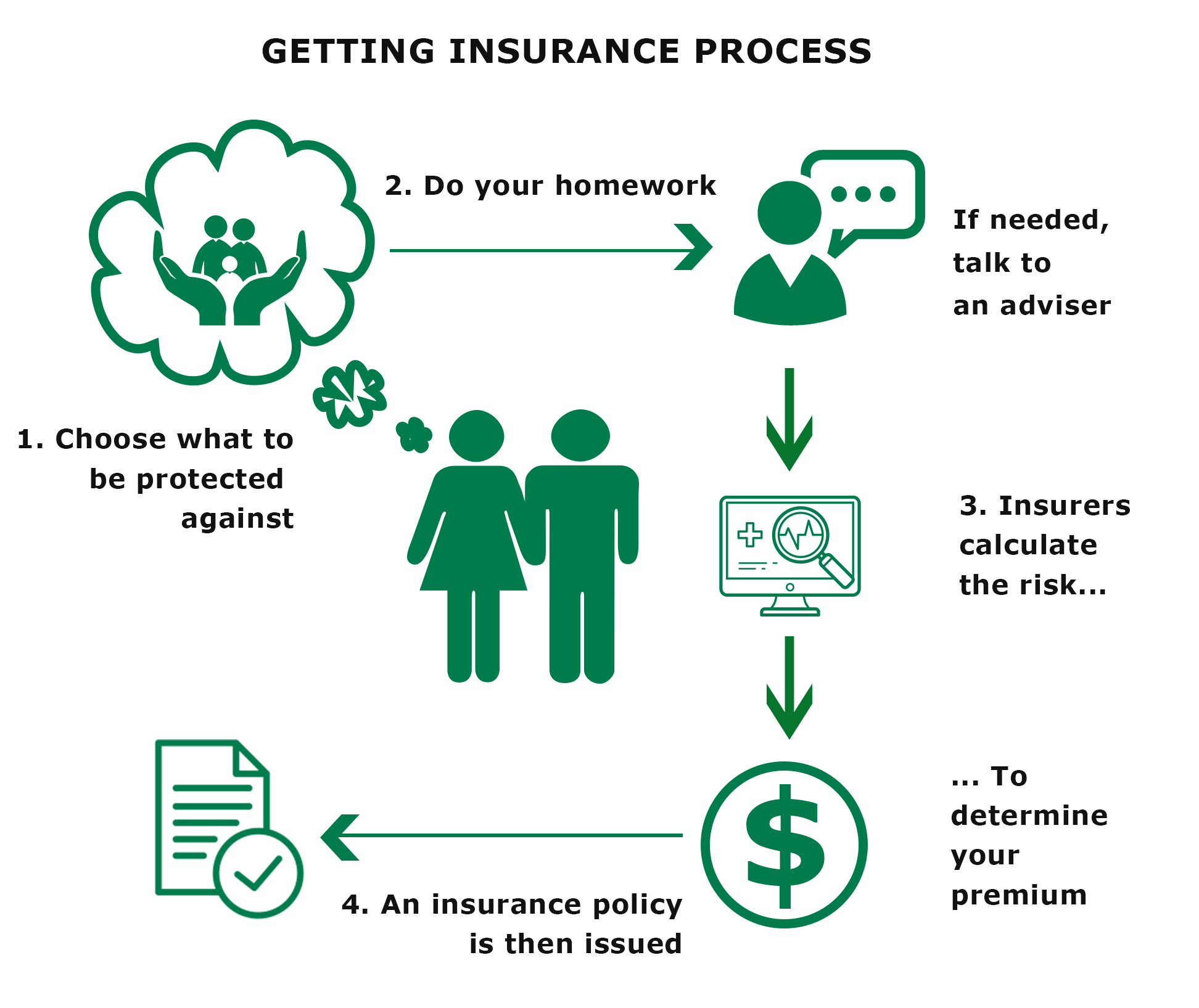

Knowing exactly how insurance works takes some initiative, yet it's crucial to understand the fundamental principles of coverage to obtain what you need. Understanding what's readily available and exactly how it works can have a major impact on the price you will pay to be covered. Equipped with this expertise, you'll have the ability to choose the ideal policies that will certainly shield your lifestyle, possessions, as well as building.

When you have something to shed, and you can't afford to spend for a loss on your own, you spend for insurance coverage. By paying money every month for it, you receive the comfort that if something fails, the insurance coverage firm will certainly pay for things you need to make life like it was before your loss.

The insurance business has several customers. They all pay premiums. Not every client will have a loss at the same time. When a loss occurs, they may obtain insurance policy money to spend for the loss. Every person does not have to get it, yet it is an excellent concept to purchase insurance policy when you have a great deal of economic risk or financial investments on the line.

Some insurance is extra, while various other insurance coverage, like automobile, may have minimum demands laid out by regulation. Some insurance policy is not needed by law. Lenders, financial institutions, and also home loan companies will certainly need it if you have actually obtained cash from them to make an acquisition worth a great deal of money, such as a home or a cars and truck.

Some Known Factual Statements About Paul B Insurance

You will require automobile insurance if you have an auto loan and residence insurance if you have a home mortgage. It is often required to receive a loan for big acquisitions like residences. Lenders wish to ensure that Visit Website you are covered against dangers that might trigger the value of the automobile or home to decline if you were to endure a loss before you have actually paid it off.

This is not an excellent suggestion. Lender insurance is a lot more pricey than the plan you would get by yourself. Some companies may have discount rates tailored at bringing in particular kinds of clients. How well your profile fits the insurer's account will certainly factor right into exactly how excellent your price will certainly be.

Various other insurance providers may develop programs that offer larger discounts to seniors or members of the armed force. There is no chance to know without going shopping around, comparing policies, and also getting quotes. There are three major reasons that you must acquire it: It is required by law, such as obligation insurance for your vehicle.

A monetary loss can be past what you might manage to pay or recuperate from conveniently. If you have costly computer system equipment in your home, you will certainly desire to acquire tenants insurance coverage. When the majority of people assume concerning individual insurance coverage, they are most likely important site thinking of among these five significant kinds, to name a few: Residential, such as residence, condominium or co-op, or occupants insurance policy.

The Facts About Paul B Insurance Revealed

Watercraft insurance coverage, which can be covered under house insurance coverage in some scenarios, and also stand-alone watercraft insurance coverage for vessels of a specific speed or size that are not covered under house insurance policy. Health and wellness insurance policy as well as life and also special needs insurance coverage. Obligation insurance, which can fall under any of these teams. It covers you from being taken legal action against if another person has a loss that is your fault.

Insurance policy needs licensing and also is split into groups. This indicates that before somebody is legally permitted to offer it or provide you with recommendations, they must be certified by the state to sell and offer advice on the type you are purchasing. Your residence insurance coverage broker or representative may tell you that they do not provide life or special needs insurance policy.

If you're able to buy more than one kind of policy from the exact same person, you might be able to "pack" your insurance as well as get a discount rate for doing so. This includes your primary house along with any other structures in the room. You can locate fundamental wellness benefits along with various other health policies like dental or long-term treatment.

The Best Strategy To Use For Paul B Insurance

:max_bytes(150000):strip_icc()/basics-to-help-you-understand-how-insurance-works-4783595_final-9cf74d5b66d14f88a21ab29ddb290e2d.png)

:max_bytes(150000):strip_icc()/how-does-health-insurance-work-f7aa9125e51f4f6698b38789ff3929c3.png)

If Get More Information you get a really low price on a quote, you ought to ask what type of policy you have or what the limitations of it are. Policies all consist of certain areas that note limits of amounts payable.

You can frequently ask for the type of policy that will use you greater restrictions if the restrictions shown in the policy concern you. Some kinds of insurance policy have waiting durations before you will be covered.